39+ can you still deduct mortgage interest

Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Fixed Variable Rate Uk Mortgage Repayment Calculator

Web The mortgage interest deduction can also apply if you pay interest on a condo cooperative mobile home boat or RV used as a residence.

. Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully deductible. For tax years before 2018 the. Web Important rules and exceptions.

The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Also if your mortgage balance is 750000. 13 1987 your mortgage interest is fully tax deductible without limits.

Web If your adjusted gross income AGI is below 100000 50000 if married and filing separately you can deduct your mortgage insurance premiums in full. Web Most homeowners can deduct all of their mortgage interest. Web You cant deduct the principal the borrowed money youre paying back.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Homeowners who bought houses before December 16 2017 can. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

The deduction is not available for loans. Web For mortgages taken out since that date you can only deduct the interest on the first 750000 375000 if you are married filing separately. Web You can still claim the mortgage interest deduction but due to the lowering of limits and the changing of the criteria it will rarely be worth it for most Americans.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web A mortgage calculator can help you determine how much interest you paid each month last year. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

You may still be able to. Note that if you were. You can claim a tax deduction for the interest on the first.

Web The interest on a home equity loan is tax-deductible if the loan is used to purchase build or improve your main home. If you took out. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

Web If you itemize your deductions on Schedule A of your 1040 you can deduct the mortgage interest and property taxes youve paid. However higher limitations 1 million 500000 if married. Web Mortgage interest is currently tax deductible up to the total amount of interest paid in any given year on the first 750000 of your mortgage or 375000 if.

Web If you took out your mortgage on or before Oct. In addition to itemizing these conditions must be met for mortgage interest to be. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000.

Get The Answers You Need Here. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Mortgage Interest Tax Deduction 2022 What If You Forget

5 Ways To Shave 25 Percent Off Your Mortgage Rate Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Create An Amortization Schedule In An Access Database Quora

Mortgage Calculator Pmi Interest Taxes And Insurance

![]()

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

49 Monthly Report Format Templates Word Pdf Google Docs Apple Pages

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Goodbye 25 Year Mortgages But Are We Walking Into A Borrowing Trap Mortgages The Guardian

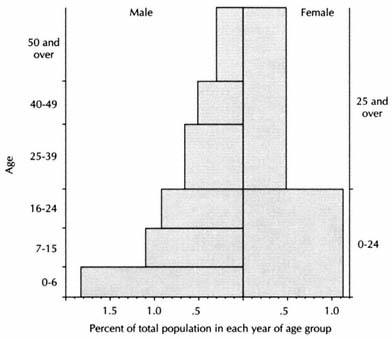

Rural Change And Royal Finances In Spain D0e13063

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Is A 35 Year Mortgage Right For You

Maximum Mortgage Tax Deduction Benefit Depends On Income

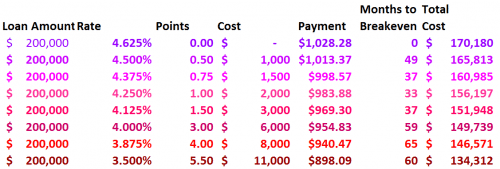

Analyzing Interest Rates When Is 2 99 More Than 5 Truth Concepts

Rural Change And Royal Finances In Spain D0e13063

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Bankrate

A 4 Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast